It’s understandable that a lot of the language and blogs when you look at the a home loan commitment is going to be confusing. Whenever people lender was capital a loan that’s covered from the a residential property, needed the debtor and you may home owner posting its insurance coverage plan to obtain the financial named as losings payee. Luckily, this course of action is straightforward, short, and will not ask you for anything.

You’ve today accomplished the newest lender’s requirements about your homeowners insurance coverage

What you need to would are label your current home insurance organization and ask them to range from the this new financial just like the an effective losings payee and that’s one to.

Rather than an energetic home insurance coverage, you are in violation of home loan deal in addition to financial can officially initiate the process of alerting you regarding their correct commit energy regarding business if your insurance is perhaps not reinstated on the house.

For many who discovered for example a notification, easily fix the issue along with your insurer or get a hold of various other insurer as quickly as possible.

Degree information regarding mortgage and domestic security loans can be acquired online or by way of a mortgage broker. You can always browse the new Clover Mortgage website filled with useful stuff, systems, and you may resources geared towards degree and getting a powerful foundation of education in order to homeowner and homebuyers. Feel free to name or current email address me to Dolores cash advance loans speak with that in our knowledgeable and of good use mortgage brokers that would feel happier for taking time to provide you with of use training regarding the home loan techniques.

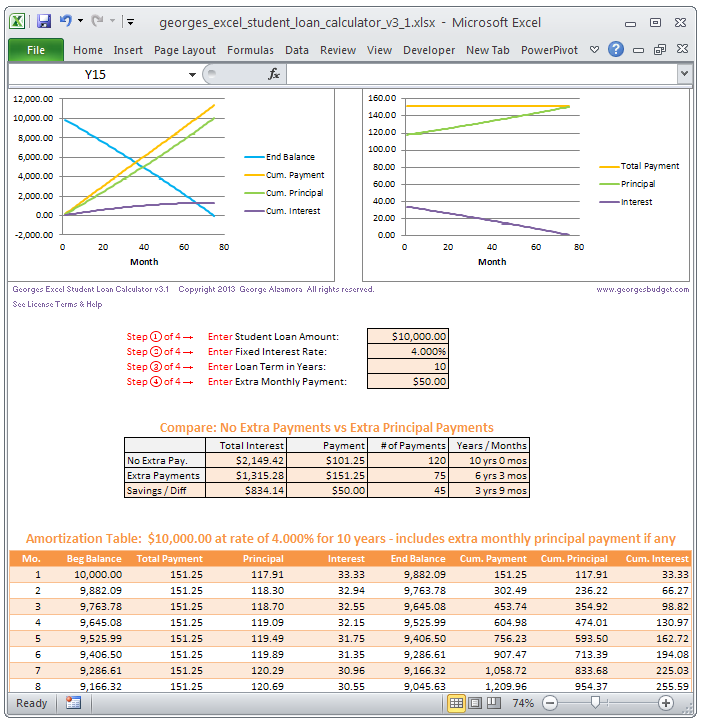

You need to use our house equity calculator to see exactly how much collateral will come in your property. Our mortgage repayment calculator will help you to assess exactly how much their month-to-month mortgage payments would-be to the brand new mortgage. The loan re-finance calculator will assist you to see a little more about how much of a good homer refinance you can buy. The latest Clover Home loan cost calculator makes it possible to know the way far from a mortgage you can afford.

When looking at family security loans in Ontario particularly, it is vital to note that a home in some big places for example Toronto, Mississauga, Oakville, Burlington, Milton, Barrie, The fresh new, Scarborough, Ajax, Oshawa, Pickering, Aurora, Richmond Hill, Kitchener, Waterloo, Cambridge, London area Ontario, Ottawa, or any other biggest urban area centers might have specific gurus over a beneficial household various other even more outlying portion. Because areas was healthier, considerably better, and you can constant in these alot more heavily inhabited parts, a resident on these categories of urban centers will usually have availability to private lenders that will enable it to be their property guarantee loan to help you go up to the next mortgage so you’re able to really worth, or as you may know that it is described as LTV.

Our very own mortgage brokers will help you explore the options as well as other financial alternatives, for instance the choice to re-finance your existing home loan from the an effective ideal rate, and make certain you will be making ideal economic choice for yourself and your residence. Finding the optimum solutions to your financial demands is vital getting building a much better financial future loaded with suitable savings you really need to please feel free.

If their insurance plan lapses or gets cancelled, you, the financial, as well as your mortgage broker gets informed by the post nearly quickly

In the example of a great HELOC of a choice financial you to goes into second standing, one benefit and you may advantageous assets to the item ‘s the simple fact that its easier to qualify for than an effective HELOC by way of a antique bank or lending institution. While the by and large this type of security loan try given thanks to private lenders, the procedure to utilize and have now approved are easier, reduced, and less dilemma than a more old-fashioned home loan from house equity personal line of credit application.

Sure, there are period in which homeowners are declined when they submit an application for a house equity loan. In these instances, there may not adequate offered guarantee leftover so you can lend towards the, the home would-be inside the worst or unliveable status, the region of the house property would be as well remote, or for many other possible explanations.

When it comes to a second financial otherwise third mortgage, or a HELOC inside the 2nd standing, you are not capable of getting mortgage standard insurance policies.